-

Sort By

-

Newest

-

Newest

-

Oldest

Climate risk has “never been higher on investors’ agendas” – but the strategies they use to combat itoften have conflicting features. Lack of data only compounds the problem. Martha Brindle, director of equities in bfinance’s public markets team and Sarita Gosrani, director of ESG and responsible investment (both based in London) note that there are…

When David Brand launched New Forests in Sydney in 2005, only 10 per cent of the global forestry asset class resided outside the US and the largest investor was America’s Hancock Natural Resources Group. Now, Hancock, a subsidiary of Manulife Investment Management, is still the largest forestry investor in the world, but Australia’s New Forests…

Difficult to define and more difficult still to measure, the culture of any organisation is widely regarded as having a major impact on performance. Funds management is no exception. Asset consultant Frontier has this year been striving to add some detail and colour to the picture to help its clients, and itself, in the process…

The Financial Services Council (FSC) fought to keep its submission on the proposed proxy advice reforms confidential for fear it would “play out in the media”. The FSC’s submission to Treasury on its proposed proxy advice reforms has been kept confidential despite a freedom of information request for its release, with the FSC concerned that…

Howard Marks, one of the investment world’s more celebrated investors, has added his voice to other celebrated investors in decrying continued use of the terms ‘value’ and ‘growth’. The co-founder and co-chair of Oaktree Capital Management, Los Angeles-based, predominantly fixed income and credit strategies, firm addressed the opening session of the CFA Societies Australia conference,…

Dutch asset management giant, Robeco, tips a mainly positive, if subdued, outlook for equities over the next five years but with a high degree of uncertainty ahead in a decade it dubs the ‘Roasting Twenties’. In its new five-year forecast returns paper, Robeco says “we expect risk-taking to be rewarded in the next five years,…

The 2020s are set to be the years of thematic investing – but so were the early 2000s. And the more things change, the more they stay the same. One of the problems in thematic investing is figuring out what’s a theme and what’s just plain old trendy. But that problem is also a problem…

Kim Catechis says he was not pessimistic when he wrote ‘Deep Water Waves’, his first major strategy report for investors through the Franklin Templeton Investment Institute. The report, published in August, sparked a series of discussions within and outside the Franklin Templeton group. If one of these is a guide, from an investor webinar held…

The first thing funds usually consider in a merger is cost to member – but that won’t necessarily be what leaves them better off. The trick is getting the alignment right. According to David Carruthers, senior consultant and head of the members solutions group at Frontier, the top priority for any fund considering a merger…

As AustralianSuper continues to grow, Mark Delaney is focusing his attention on the burgeoning private markets space and the problem of culture in megafund land. “Size can creep up on you. You stand still, and all of a sudden you’re bigger than what you think you are. I first started managing pension money 20 years…

Investors looking to arbitrage index ins-and-outs would have seen shrinking rewards for their efforts over the last 25 years based on the findings of a new S&P Dow Jones Indices (S&PDJI) paper. The S&P study found a “structural decline” in the so-called ‘index effect’ where share prices bounce up on entering key market benchmarks and…

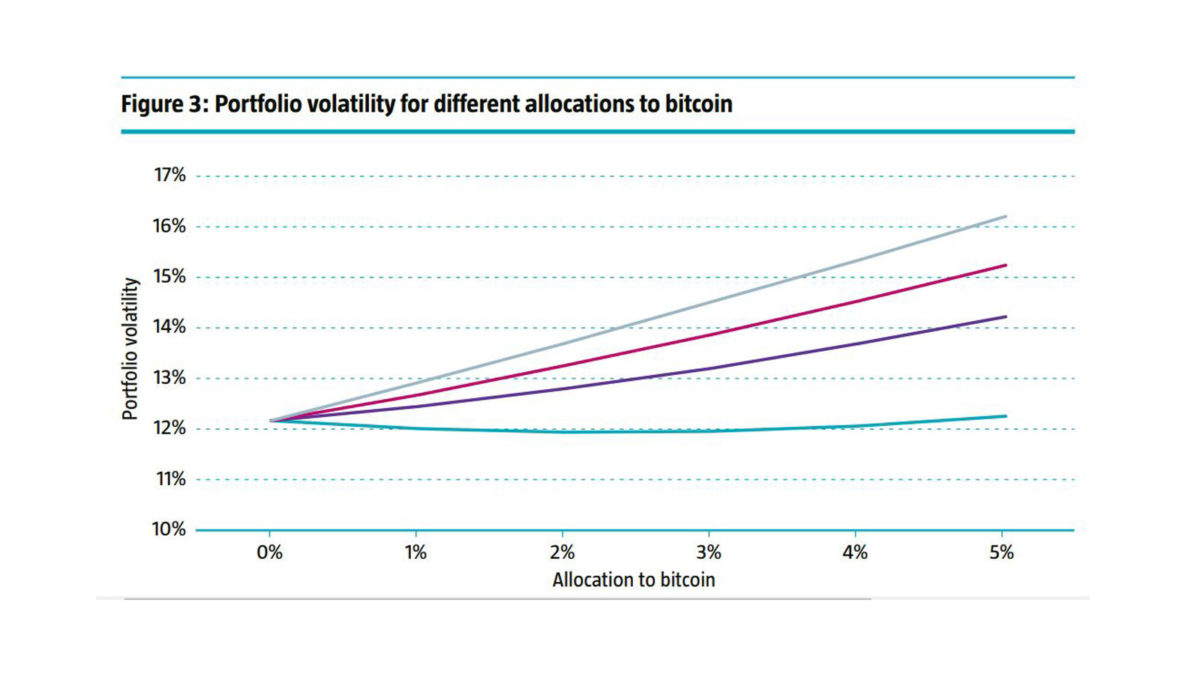

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day. Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can…