-

Sort By

-

Newest

-

Newest

-

Oldest

Despite the popularity of that old adage, it’s never as simple as “buy low, sell high”. But if it’s not true, what are investors to do? “Everyone is familiar with the old saw that’s supposed to capture investing’s basic proposition: “buy low, sell high”,” writes Oaktree Capital founder Howard Marks in his latest memo, ‘Selling…

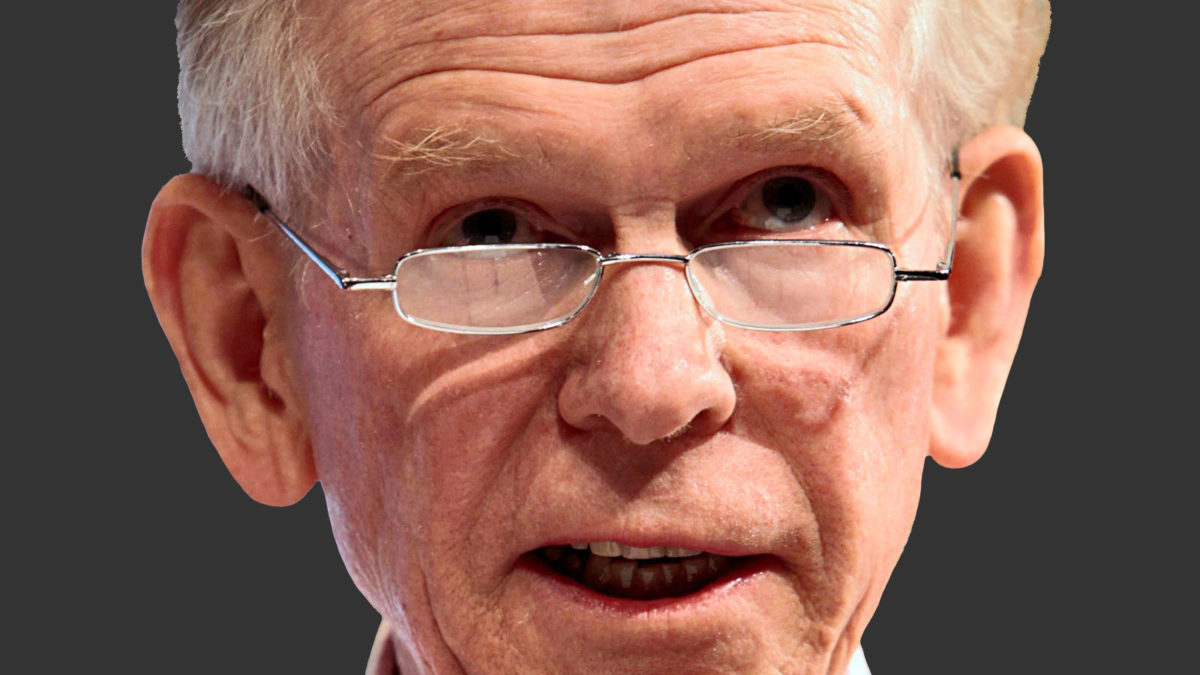

Jeremy Grantham believes the “superbubble” he’s been warning about for years is now on the brink of collapse – and that the “wild rumpus” can begin at any time. Calling the collapse of a market bubble is anybody’s game. One needs only to know that it exists – something now patently obvious to any investor…

Emerging markets have languished for years despite their explosive economic growth. But the new inflationary epoch – and a burgeoning focus on ESG – might turn all that around. Emerging markets can be a tough game. A decade of lackluster performance compared to their developed market counterparts has culminated in massive regulatory upheaval in China,…

The problems with Your Future Your Super (YFYS) run deep – among them, how super funds will manage ESG within the confines of low tracking error strategies. But it’s not the end of the road. Under the YFYS reforms, implementation manager Parametric believes tracking error will face downwards pressure as funds try to stay on…

The tide is coming in for inflation – but that doesn’t mean there won’t be significant volatility along the way. Investors need to figure out which parts of the economy will catch fire first. “Views on the direction of inflation can be quite fascinating, but only ‘quite’ since no one really knows what they are…

By 2041, Australia’s super funds will swell to enormous size. How they invest our retirement savings will become an even trickier prospect. Over the next 20 years, the superannuation system will grow to a colossal size – an estimated $9.2 trillion, or 206 per cent of its current size, according to a report from Deloitte’s…

Cash is still trash for hedge fund legend Ray Dalio, who believes the world is entering a new paradigm characterized by internal and external conflict that will only intensify in the years ahead. Dalio, founder of Bridgewater Associates and one of those polymath billionaire investors who frequently turn their attention to issues beyond pure finance,…

This is the last edition of Investor Strategy News for the year. We will next publish on January 10, 2022. Here are some thoughts on the year past, based on reader reactions to our stories. Our most popular for the year was our coverage of the Australian Catholic Superannuation and Retirement Fund’s APRA performance test…

No amount of hard data or compelling evidence is going to stop people who want to use their super to buy a home. And super funds might have to help out after all. The idea of using superannuation for housing has a simple allure that has seen it revived several times in the thirty-odd years…

The Morrison Government wants to present a small target on superannuation at next year’s election. But Labor has big ideas for the sector that could be impossible to match. Superannuation might well be the Liberal Party’s Moby Dick. It’s a popular policy inextricably tied to Labor and the union movement, and while they can barely…

Investor time horizons pulled back slightly while corporate capital allocators took a much longer view during 2020, according to a new study. The analysis from institutional think-tank, Focusing Capital on the Long Term (FCLTGlobal), found investor time horizons shrank by 2.3 per cent last year as companies pushed out their expected capital return timeframes by…

Investor concerns about the pandemic are fading. All eyes are now on the burgeoning threat of cyber-attacks, and what they mean for financial system stability. The Depository Trust and Clearing Corporation (DTCC) risk barometer was launched in 2013, and provides a handy insight into what’s worrying investors in any given year. And after two years…